- #Kindle direct publishing tax information how to#

- #Kindle direct publishing tax information update#

- #Kindle direct publishing tax information free#

#Kindle direct publishing tax information how to#

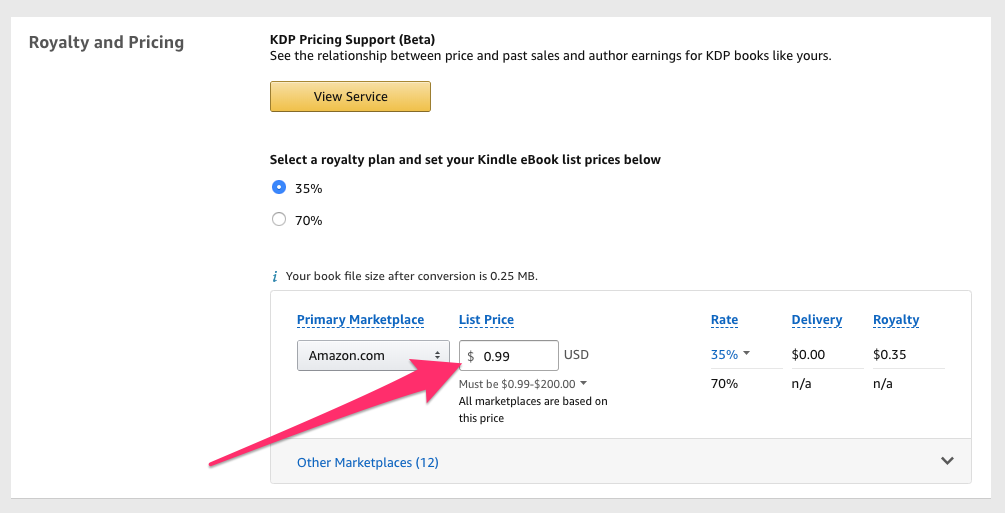

We’ll walk you through setting up an Amazon KDP account and show you how to sell books on Amazon in four simple steps. Opening an Amazon KDP account, listing, and selling books on Amazon are all free -and you get paid each time a book sells. Received my EIN/SSN within 60 Days" while taking the tax interview.Anyone can sell books on Amazon Kindle Direct Publishing (KDP). Information, either electronically or via mail, if you checked the box that states "I have The validation process can take up to eight weeks from the time Amazon receives your If you choose to mail your hard copy document instead of consenting to electronic signatures, we will require 10-15 business days to process upon receipt. If we find your information does not match IRS records, we will send you an email with instructions on how to proceed.

#Kindle direct publishing tax information update#

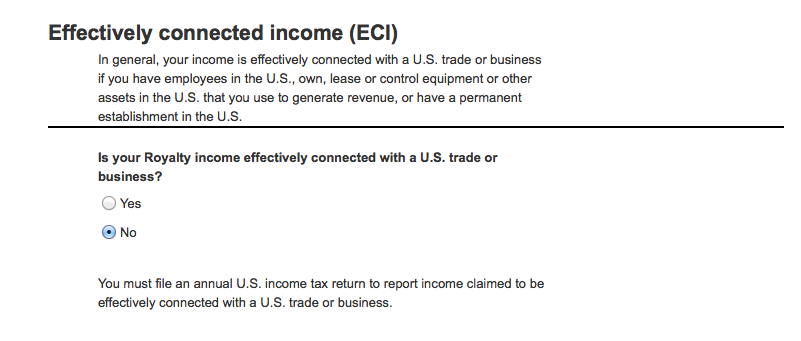

How long will it take to see if it isĪfter you update your tax identity information, the Legal Entity section of your Account Info page will display Provided and Pending Validation. I have provided my tax identity information. Maintain a current Form W-8 will result in suspension of your selling privileges. If you have received an email from Amazon stating that your Form W-8 is expiring or hasĮxpired, you must complete an updated Tax Interview to continue selling. For more information about how the IRS defines U.S. The IRS requires Amazon to maintain a current Form W-8 for merchants, individuals, orĮntities who are not U.S. I give Amazon new or updated information? I received an email stating that my Form W-8 is expiring or has already expired. Why does AmazonĪll sellers on, regardless of the number of transactions they have in aĬalendar year, are required to complete the Tax Information Interview.

I am not going to come even close to hitting the reporting threshold. Information, or other identifying information connecting the seller to the US.

In general, the IRS regulations require Amazon toĬollect identifying information from sellers who have a US address, US banking tax reporting requirements.Īdditionally, Amazon must obtain identifying information, such as a tax ID, from certain taxpayers to provide Form W-8BEN to Amazon in order toīe exempt from U.S. Responses you give to the Tax Interview wizard questions will create the appropriate tax Yes, even if you are a non-US taxpayer, you still need to provide us information and the Most cases, your TIN is either an Employer Identification Number (EIN) or a Social taxpayers, a TIN is required by the IRS for the administration of tax laws. What information do I need to provide to Amazon?īy completing the Tax Interview in your seller account, you will be providing Amazon theĪppropriate tax identity in the form of a W-9 or W-8BEN form.įor U.S.

How do I update my tax information and legal business name? You can provide your information to Amazon by clicking here to use our self-service Tax Interview process that will guide you through entering your taxpayer information and validating your W-9 or W-8BEN form. If you do not meet both of these thresholds, you will not receive an IRS Form 1099-K. More than $20,000 in unadjusted gross sales, and.Sellers who meet the following thresholds in a calendar year: third-party settlement organizationsĪnd payment processors, including Amazon, are required to file Form 1099-K for U.S. Due to Internal Revenue Service (IRS) regulations, U.S.

0 kommentar(er)

0 kommentar(er)